GA T-22B 2010 free printable template

Show details

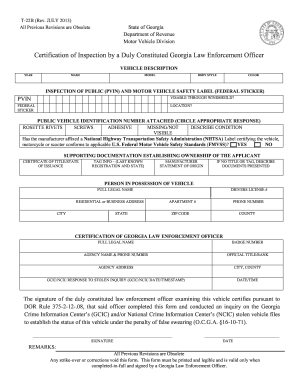

Print T-22B (Rev. 03-2010) Clear State of Georgia Department of Revenue Processing Center Motor Vehicle P O Box 740381 Atlanta, Georgia 30374-0381 (404) 968-3800 www.dor.ga.gov Certification of Inspection

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your t22b form 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t22b form 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t22b form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t 22b form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

GA T-22B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t22b form 2010

How to fill out t22b form:

01

Start by reading the instructions provided with the form. The instructions will guide you through the entire process.

02

Begin by filling out the personal information section. This includes your name, address, contact information, and any other relevant details requested.

03

Proceed to the main section of the form where you will provide specific details related to the purpose of the form. For example, if the form is for reporting income, you will need to provide details about your earnings, expenses, and any deductions applicable.

04

Ensure that you have all the necessary supporting documents as mentioned in the instructions. These could include financial statements, receipts, and any other relevant paperwork. Attach these documents to your completed form.

05

Once you have filled out all the required sections and attached the necessary documents, review your form for accuracy and completeness. Double-check all the information to avoid any mistakes or omissions.

Who needs t22b form:

01

Individuals who are required to report a specific type of information, such as earnings, expenses, or deductions, may need to fill out the t22b form. The exact requirements may vary depending on the jurisdiction and specific regulations.

02

Employers and businesses may also require the t22b form from their employees or contractors for taxation or reporting purposes. This form allows them to gather necessary information to comply with legal and regulatory obligations.

03

Additionally, individuals who are self-employed or have income from multiple sources may need to fill out the t22b form to accurately report their earnings and deductions.

Overall, the t22b form is typically required for individuals and businesses to fulfill their reporting obligations and provide accurate financial information to the relevant authorities.

Video instructions and help with filling out and completing t22b form

Instructions and Help about ga vin verification form

Fill t 22b revised 5 2020 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file t22b form?

The T22B form is generally used by employers to report the taxable benefits they provide to their employees. All employers who provide taxable benefits to their employees must file this form with the Canada Revenue Agency (CRA).

What is the purpose of t22b form?

The T22B form is a tax form used by Canadian residents to report their foreign income and income from foreign investments. This form is used to calculate how much tax the individual owes for the income they earned outside of Canada and to report any foreign tax credits they may be eligible for.

How to fill out t22b form?

1. Begin by filling out your personal information at the top of the form. This includes your name, address, Social Insurance Number (SIN), and date of birth.

2. Enter your employer's information. This includes the name and address of your employer, their CRA business number, and payroll program account number.

3. Enter your income information. This includes your total income for the year, total deductions, and net income.

4. Enter your tax information. This includes your federal and provincial tax amount, total tax withheld from your income, and any additional tax you owe.

5. Sign and date the form, and submit it to the Canada Revenue Agency (CRA).

What is t22b form?

There is no specific information available on a form called "t22b." It is possible that you are referring to a specific form used in a particular context, organization, or country. Please provide more details or context so that I can assist you better.

What information must be reported on t22b form?

The T22B form, also known as the "Report of Expected Academic Worksheet," is used by international students in the United States to report their expected academic program information to the Student and Exchange Visitor Information System (SEVIS). The following information is typically required on the T22B form:

1. Personal information: Name, date of birth, SEVIS ID number, gender, nationality, and contact details.

2. School information: Name and address of the school or institution where the student intends to study.

3. Program information: Start and end dates of the academic program, degree level (such as undergraduate or graduate), major or field of study, and expected date of completion.

4. Financial information: Estimated educational expenses, including tuition fees, living costs, and any scholarships or funding sources.

5. Accommodation details: Information about housing arrangements, such as on-campus housing or off-campus accommodations.

6. Dependents: If the student is accompanied by any dependents (spouse or children), their names, dates of birth, and relationship to the student must be included.

7. Health insurance: Proof of health insurance coverage for the student and dependents, including policy details and provider information.

8. Travel plans: Arrival and departure dates, as well as airport and flight details, if available.

It is important to note that specific requirements may vary depending on the school, program, and individual circumstances. Students should consult their designated school officials or immigration advisors for accurate and up-to-date information on completing the T22B form.

What is the penalty for the late filing of t22b form?

The penalty for late filing of the T22B form can vary depending on the jurisdiction or specific regulations in place. It is advisable to consult the applicable regulations or seek advice from a legal professional for accurate and up-to-date information regarding penalties for late filing of the T22B form in a specific jurisdiction.

How do I make changes in t22b form?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your t 22b form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the georgia vin verification form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your vin verification form ga right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out t 22b using my mobile device?

Use the pdfFiller mobile app to fill out and sign t22b form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your t22b form 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Georgia Vin Verification Form is not the form you're looking for?Search for another form here.

Keywords relevant to t22 form

Related to georgia t22b form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.